california nanny tax rules

Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. Congress should prioritize evaluation of recent international tax trends and the model rules and adjust US.

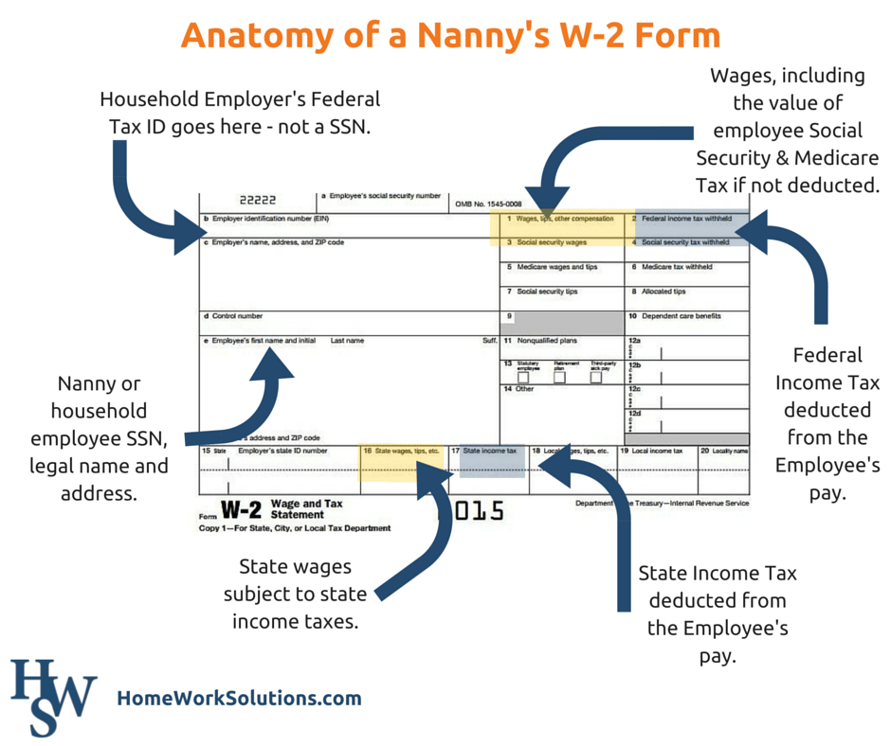

A Nanny Asks Questions About Form W 2

These required minimum distributions or RMDs prevent you from further deferring tax payments.

. With tools for job search resumes company reviews and more were with you every step of. Some states have more complex tax requirements at the jurisdiction level and we work hard to help small business owners navigate those tax complexities. Minimum wage rates are on the rise for 2022 in many states counties and cities across the country.

This policy intervention is an effort to decrease obesity and the health impacts related to being overweight. The federal minimum wage rate was raised to 725hour in 2009. The federal tax return for Jack and Jill a married couple who are California residents shows the following income and adjustments on their 2015 Form 1040.

Youll find the deduction on your personal income tax form and you can file for it if you were self-employed and showed a profit for the. Nannies and other household employees are covered by the Fair Labor Standards Act which means they must be paid the prevailing minimum wage rate. Rules in a way that supports investment and innovation and moves towards simplicity.

In fact we support over 6000 active taxes across the US. What is the SUI Tax Rate. A 403b is essentially a 401k for employees of non-profit tax-exempt businessesthink schools universities churches and religious organizations or hospitals.

Altered bagels sliced toasted or. Sales tax for sliced bagels If you order a sliced bagel in New York City fuhgeddabout a square deal. SUI tax rates are part of the payroll taxes you are responsible for paying as a small business owner.

A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. The deduction which youll find on Line 17 of Schedule 1 attached to your Form 1040 allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. Tax rules and contribution limits are the same as 401ks.

SUI which stands for State Unemployment Insurance is an employer-funded tax that offers short-term benefits to employees who lost their jobs through a layoff or a firing that is not misconduct related. At SurePayroll we stay on top of all federal state and local tax codes to ensure your small business is always compliant.

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Tax Do I Have To Pay It Credit Karma

How To Do Your Nanny Taxes The Right Way Marin Mommies

The Temporary Nanny And Her Taxes

Help I Was Given A 1099 Nanny Counsel Nanny Nanny Tax Nanny Contract

California Durable Power Of Attorney Form Power Of Attorney Form Power Of Attorney Being A Landlord

Guide To Paying Nanny Taxes In 2022

How To Get Caught Up On Nanny Taxes At Year End

The Right Time To Put A Nanny Or Caregiver On The Books Hws

How Does A Nanny File Taxes As An Independent Contractor

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

Nanny Tax Calculator Nanny Lane

Discount At Nannypod Nanny Agencies Babysitter Part Time Nanny

Nanny Tax Pitfalls And Need To Knows For Your Taxes

:max_bytes(150000):strip_icc()/woman-giving-her-daughter-to-nanny-157859358-7051092d95214d9b930da5dabb7a3d50.jpg)